Financial Impact Advocates

Real-Time Veteran-Founded Company Performance

-

Veteran entrepreneurship has reached a scale where anecdote is no longer sufficient, yet existing economic frameworks do not systematically surface veteran-founded or veteran-led activity. This dashboard exists to make that activity visible at a policy and ecosystem level, at a moment when capital formation, workforce transition, and national competitiveness are increasingly interconnected.

-

Companies shown may be “veteran founded” or “veteran led” based on public disclosures. Leadership, ownership, and affiliations can change over time. Inclusion does not imply endorsement, partnership, or ongoing control by any individual. [Publicly traded companies with documented veteran founders, executives, or historical leadership influence.]

-

Market data displayed is for informational and educational purposes only and may be delayed. It is not investment advice. Verify prices and company information through official sources before making any financial decisions. Veteran-Associated Companies include publicly traded firms founded, co-founded, or historically led by U.S. military veterans, or companies with documented veteran leadership or legacy involvement. Inclusion does not imply current ownership or endorsement.

-

Some interactive modules are delivered via embedded third-party widgets. If a widget fails to load, refresh the page or try a different browser.

What industries show the strongest veteran entrepreneurship patterns?

-

Utilities shows the highest share of veteran-owned firms (veteran ownership representation is highest in this sector).

-

Professional, Scientific, and Technical Services has the most veteran-owned employer businesses.

-

The SBA infographic highlights elevated veteran ownership shares in Finance & Insurance, Management of Companies and Enterprises, Manufacturing, Agriculture, and Mining/Oil & Gas relative to the all-sector baseline.

Government Impact Advocates

Veteran Business Ownership by the Numbers

Veteran vs. Civilian Business Ownership Share (U.S.)

-

Estimates are derived from publicly reported federal cost data, SBA veteran business averages, and conservative revenue assumptions. Estimates use conservative federal cost assumptions for recruitment, training, and benefits, combined with illustrative averages of veteran-owned business revenue over a 10-year horizon. Figures are intended for comparative policy analysis and do not predict individual outcomes. The tools presented here are exploratory and illustrative, relying on publicly available disclosures and evolving classification methods rather than definitive or comprehensive market coverage.

-

Results are scenario-based estimates sensitive to assumptions (cost inputs, time horizon, output proxies). The tool does not account for inflation, discount rates, sector variance, survivorship, taxes, or macroeconomic shocks unless explicitly stated.

-

This scenario models a representative veteran entrepreneur and is not predictive. This calculator is a simplified, illustrative model intended for policy and educational discussion. It does not predict individual outcomes or business performance and should not be used for financial planning.

QUICK LINKS

Veteran Charity Impact Advocates

Veteran Business Trends

Veteran vs. Civilian New Business Starts U.S. (2019–2024)

Just For You

-

Written By Chynelle Washington

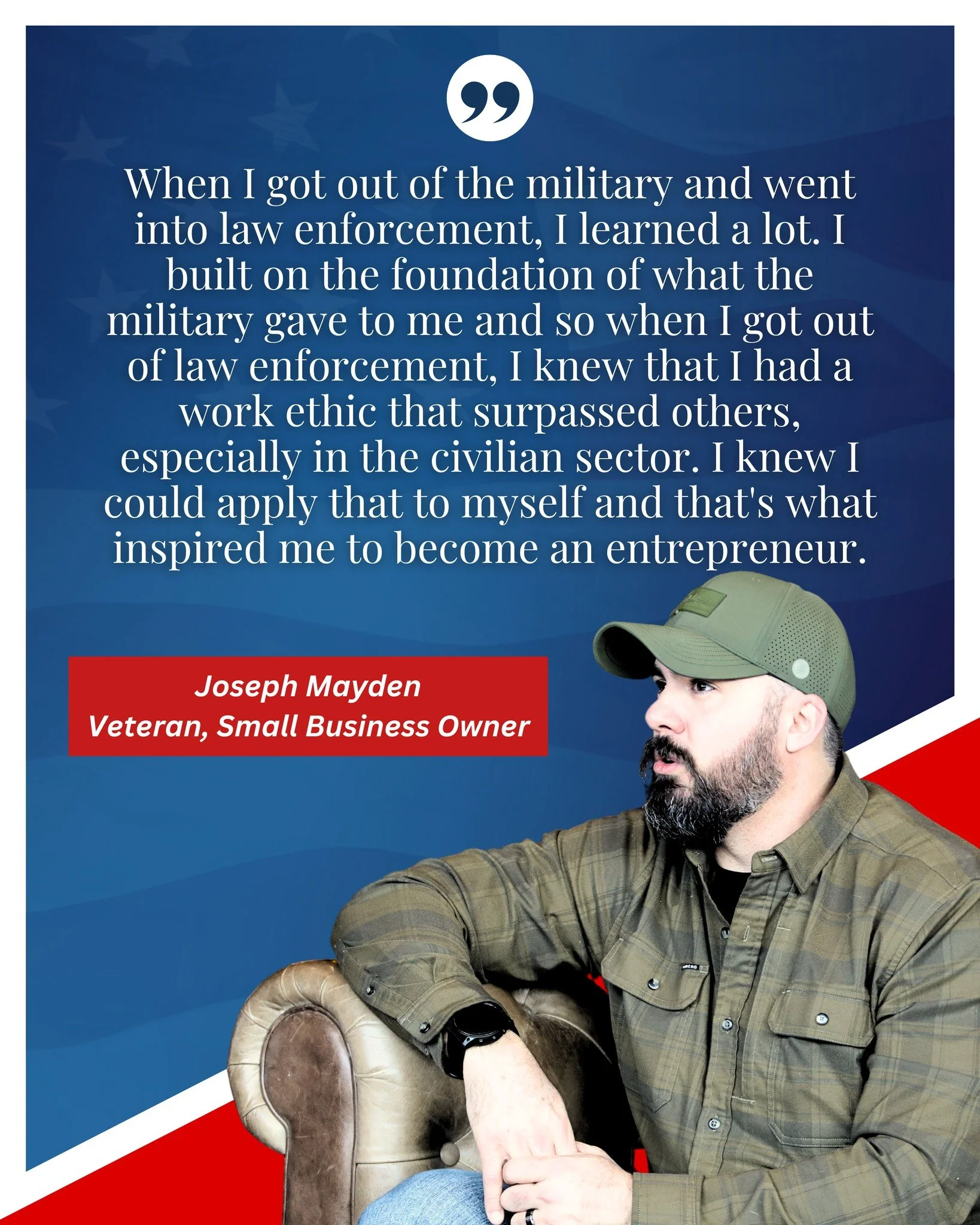

Humans at the Helm: How AI Is Being Used to Find America’s Next Veterans

-

Long-time Public Address (PA) Announcer for the Anaheim Ducks NHL Team

“In the arena, we cheer for heroes.

In the economy, we invest in them.”

— Phil Hulett -

Phil Hulett Elevates National Invest In Veterans Week®

“Don’t Just Cheer for Veterans—Invest in Them”: Phil Hulett Elevates National Invest In Veterans Week®

MARCH 1-7

Veteran Employer + Nonemployer Business Counts (U.S., 2022)

Corporate Business Impact Advocates

Economic Impact: By the Numbers

-

Average Revenue per Business 💵

Calculation

Total Revenue: $922.2 billion

Number of Businesses: 304,823

Average Revenue per Business: $3.03 million

Formula: Total Revenue ÷ Number of Businesses

📊 Result

Each veteran-owned business generates an average of approximately $3.03 million in revenue annually.💡Insight

This figure highlights the impressive revenue capacity of veteran-owned businesses across the country, underscoring their economic impact and resilience. -

Average Revenue per Business 💵

📐 Calculation

Total Revenue: $922.2 billion

Number of Businesses: 304,823

Average Revenue per Business:$3.03 million

Formula: Total Revenue ÷ Number of Businesses

📊 Result

Each veteran-owned business generates an average of approximately $3.03 million in revenue annually.💡 Insight

This figure highlights the impressive revenue capacity of veteran-owned businesses across the country, showcasing their economic impact and contribution. -

Average Employees per Business 👥

📐 Calculation

Total Employees: 3.3 million

Number of Businesses: 304,823

Average Employees per Business: 11 employees

Formula: Total Employees ÷ Number of Businesses

📊 Result

Each veteran-owned business employs an average of about 11 people.

-

Veteran-Owned Business Averages

💵 Average Revenue per Business

$3.03 million

👥 Average Employees per Business

11 employees

📊 Average Payroll per Business

$590,195

---

Source: U.S. Census Bureau. (2023, March 16). Annual Business Survey provides data on employer business characteristics. Census.gov. https://www.census.gov/newsroom/press-releases/2023/annual-business-survey-employer-business-characteristics.html

Quick Links

Veteran-Owned Business Economic Output (Receipts)

Detailed Market Performance

-

Companies shown may be “veteran founded” or “veteran led” based on public disclosures. Leadership, ownership, and affiliations can change over time. Inclusion does not imply endorsement, partnership, or ongoing control by any individual.

-

Market data displayed is for informational and educational purposes only and may be delayed. It is not investment advice. Verify prices and company information through official sources before making any financial decisions. The primary use of this dashboard is to inform policy discussion, ecosystem design, and strategic inquiry—not to guide individual investment or financial decision-making.

MARCH 1-7